3 APAC Mobile Markets To Watch in 2023

3 APAC Mobile Markets To Watch in 2023

2022 saw strong growth in many of APAC’s emerging mobile markets. With some forecasting an 8.5% compound annual growth rate for South-East Asia up to 2027, it’s a good time to look at where local gamers put their money, and what genres they tend to play.

Vietnam

Vietnam currently looks like one of the world’s strongest emerging mobile markets. The country has a population of nearly 100 million people with a median age of 32.7, making it a strong target for mobile. In general, the country’s mobile gamers tend to favor more traditional genres, with little attention paid to casino games, compared to global averages.

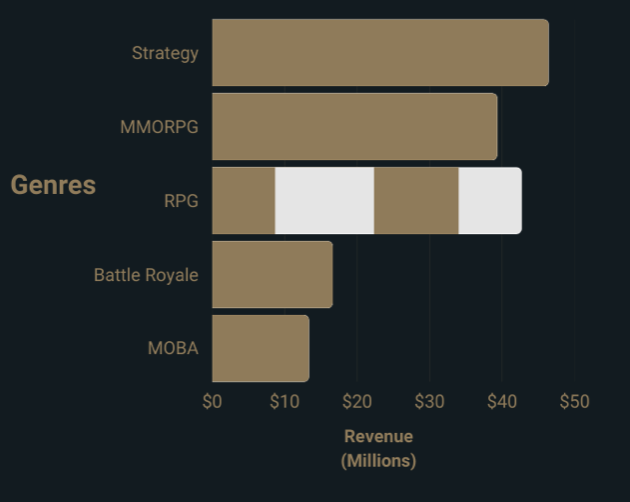

As you can see in the graph, Strategy games dominate mobile revenue in Vietnam, followed closely by MMORPGs. It’s pretty impressive to think that MMORPGs have similar mobile revenue to 4 sub-genres of more traditional RPGs, that we’ve combined above. It’s worth noting that all of these are more “serious” genres, showing how invested gamers in Vietnam typically play on mobile, rather than PC or console.

Vietnam is often referred to as a mobile focused culture, due to having over 68 million smartphone users. They rank 2nd only to China for hours spent per-week gaming. On top of that, studies have found that 23% of the time spent on mobile in the country is focused on gaming, higher even than watching videos or browsing social media. With a mobile market forecast to hit over $300 million by 2025, it’s a great time for developers and publishers to consider Vietnamese localization if they haven’t so far.

Indonesia

Indonesia has been discussed for many years as one of South-East Asia’s biggest emerging markets. Indonesia, like Vietnam, is also often referred to as a mobile focused gaming culture, with most gamers not owning a PC or console. Within the mobile segment, most gamers use Android devices.

The country’s players rank 4th for time spent gaming weekly, ahead of the global average and all western countries. Combined with projections that around 90% of people in Indonesia will own smartphones by 2025, it suggests a strong continually growing market for mobile gaming.

It’s estimated that around only 10% of people in Indonesia speak English, meaning local gamers have to rely on Indonesian localization, or other APAC languages.

Even if these players can speak a language already localized, games that show dedication to the country through Bahasa Indonesian localization will likely be looked on favorably.

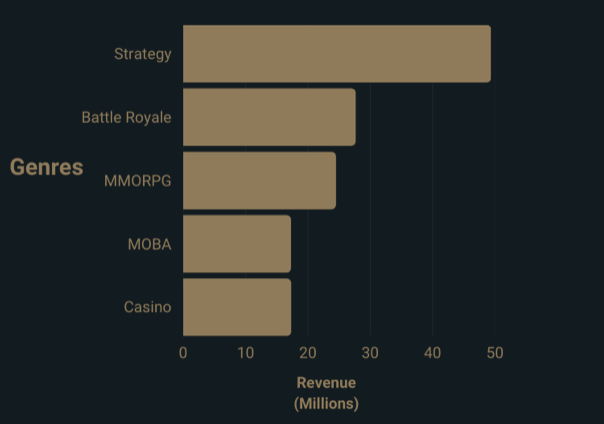

Just like Vietnam, Strategy dominates the mobile market almost doubling Battle Royale revenue. The local mobile market follows a similar trend to other APAC countries with MMORPGs and MOBAs coming in the top 5 of consumer revenue. What makes Indonesia’s market slightly different, but more typical when you look at worldwide numbers, are Casino games. But those Casino games follow one specific focus – Dominoes. While Casino games in general are popular, it’s specifically dominoes that pulls it into the top 5. It’s a great example of why developers need to pay attention to what players enjoy, rather than assuming western focuses, like slots, work everywhere.

Lastly, they’ve already recognized Esports as an official sport, likely meaning we’ll see continued growth in this area too.

Thailand

Thailand is said to be one of mobile gaming’s top emerging markets. But it’d be easy to argue it’s already emerged. Mobile games revenue in the country already tops $1 billion. Like other countries in South-East Asia, Thailand is set to keep growing at least until 2027. They’ve also made moves to recognize Esports as full professional sports which could help propel the country's games industry to new heights. In October last year Thailand was the top South-East Asian market for revenue with 23% of player spending in the entire region.

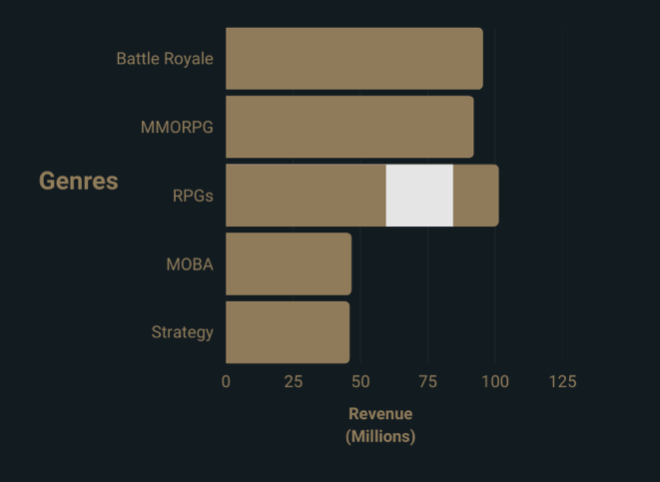

It's clear how much more lucrative Thailand’s mobile gaming market is than Vietnam and Indonesia. Thailand’s top 5 genres total over $380 million on their own. Like Vietnam, Thailand’s gamers put a lot of their money into MMORPGs but technically it’s top genre for consumer revenue is more traditional RPGs. Battle Royale games perform extremely well in Thailand, especially compared to Vietnam.

It’s also worth noting that only around 27% of people in Thailand speak English, meaning the vast majority of the population would likely prefer a game with Thai localization.

Overall, APAC’s emerging markets may be some of the mobile games industries’ biggest opportunities. This is due to the vast numbers of gamers, high-smartphone ownership, and low ownership of Console/PC. It’s worth considering localizing specifically for these countries on your next release. Especially if you’re considering expanding your language support.

In the localization industry we’re already seeing an increase of Vietnamese and Thai support in certain titles. The only difficulty is the specifics of these languages and the cultural sensitivities. We suggest that games companies should work with APAC specialists for your South-East Asian languages, guaranteeing a successful release in these lucrative, growing markets.